Why am I taking a tax quiz instead of filing my return?

Because procrastination is basically a national sport.

Nearly half of people who need to file haven’t submitted yet.

Am I the only one who would rather do literally anything else than file my tax return?

Absolutely not. 25% of those we surveyed said they’re leaving it even later than usual this year.

And 26% prefer cleaning the fridge to doing their return. That tells you all you need to know!

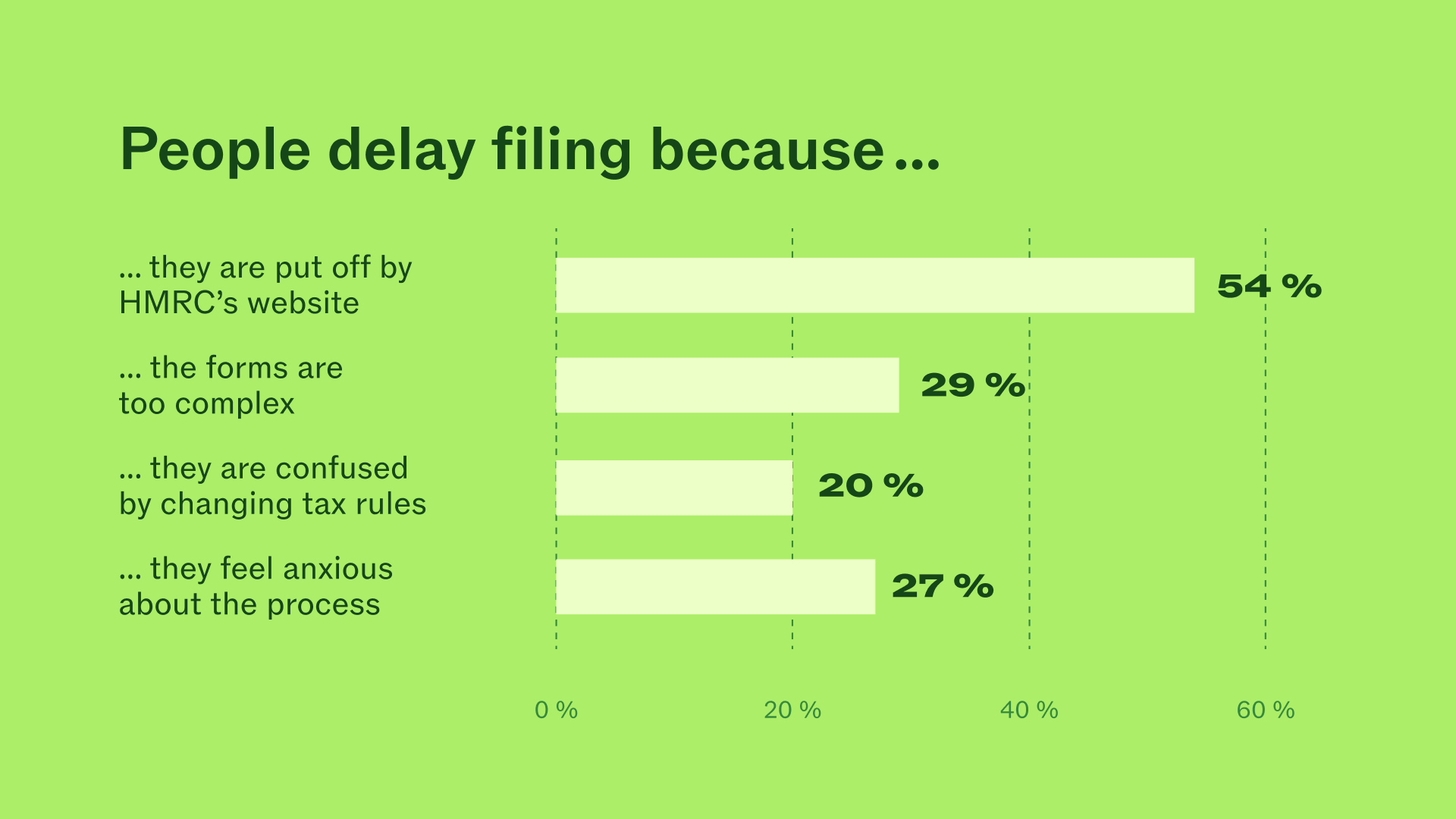

Why does filing a tax return feel so much harder than it should?

Because it kind of is.

And taxes aren’t just an isolated stress, they spill into real life:

- 32% say tax filing is the worst part of being self-employed

- 16% have questioned working for themselves because of it

- 39% felt anxious over Christmas or didn’t properly switch off

- 600,000 people say tax stress actually ruined their Christmas

Taxfix exists to fix that, by replacing confusing forms and HMRC headaches with a clear, guided process and real human support.

What happens if I keep putting my tax return off?

Short answer: it gets more expensive.

Last year, more than £110 million in £100 late-filing penalties were issued by HMRC after over one million people missed the Self Assessment deadline.

Under current rules, anyone who files late receives an immediate £100 penalty. If a return remains outstanding for more than three months, additional penalties of £10 per day can apply, up to a maximum of £900, with further penalties possible at six and twelve months.

Is it too late to find an accountant?

No, Taxfix is built for exactly this moment. Whether you’re starting late, stuck halfway through, or panicking near the deadline, get in touch.

Taxfix helps last-minute filers:

- Understand the sections of the return that apply to them

- Avoid common mistakes

- Find deductions they didn’t know they could claim

- Get their return checked by an expert accountant

No spreadsheets. No HMRC hold music. No spiral.

The research was conducted by Censuswide, among a sample of 2,000 people in the UK who have to file a self-assessment tax return. The data was collected between 02.01.25 – 07.01.25. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.